What you need to know about buying a property below market value: With reference to the above REIM article How to buy investment properties below market value | REI Invest

It is very true that property has always been one of the go-to asset classes in times of economic turmoil. This is not only the current status in the South African economy but globally.

Further to the recent Business Tech article ‘Perfect storm’ to hit middle-class South Africans: CEO (businesstech.co.za) can expect much of the same challenges to increase and assistance through impact real estate investors will be required to already impaired or distressed real estate owners (R42,7bn of residential mortgages in arrears 90 days or more) as well as the increase due to the above.

“Not everything is negotiable, but property prices are…”

This is true as with my experience in the year 1996 to 2000 when I purchased large numbers of properties at auctions for myself and other real estate investors. With auctions held at the premises, I experienced the negative social and financial effect that those sales in execution auctions had on the lives of those homeowners. Yes “sellers don’t act rationally” in those situations listed in the article and thus the situation can be either misused to enrich yourself or you can act in line with the principle “what you sow you will reap” and make an impact investment in property, by rather helping the real estate owners and make a social and financial impact in their lives, whilst making excellent predetermined returns, having the property as security at a maximum of 75% of market value (all cost included).

You may be asking “So where do you find properties below market value?” Apart from those mentioned in the article you can also visit websites and look into companies that provide impact real estate investments at well below market value

You can also find more detail about investment in impaired and distressed real estate market

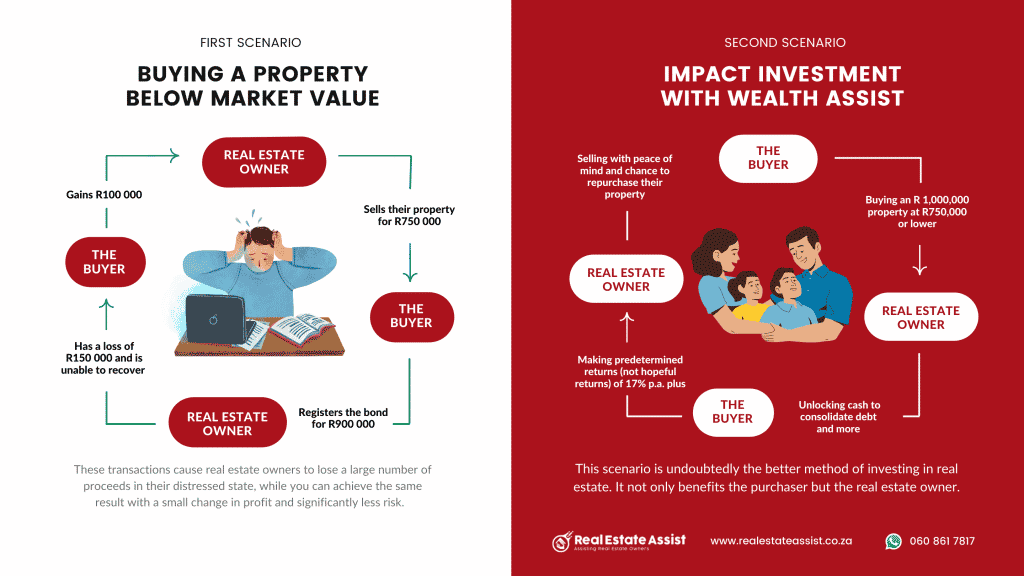

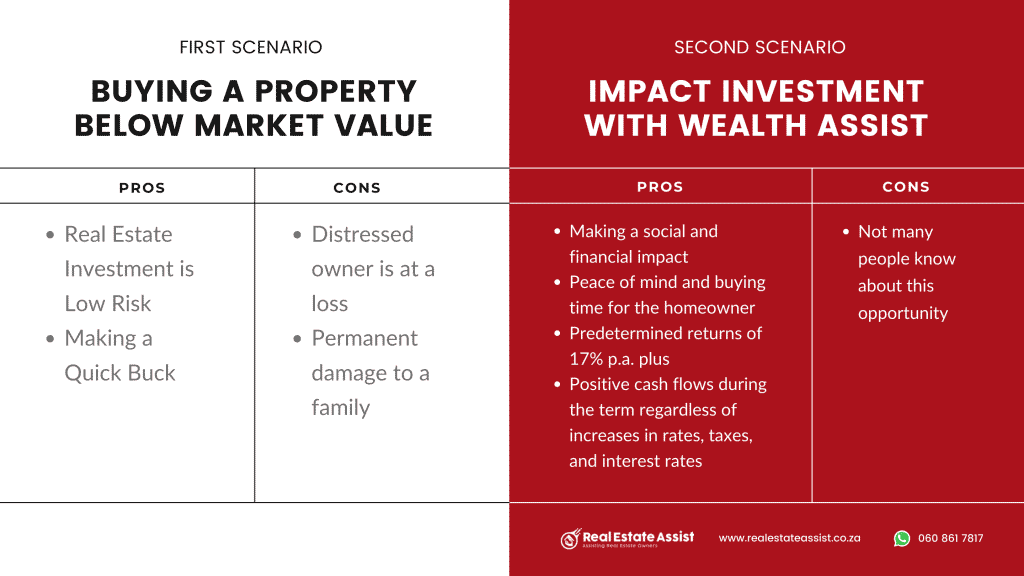

“Imagine you can buy a property with a market value of R900 000 for R750 000. You finance the property 100% and only pay the transfer and bond registration fees of about R50 000. And even though you finance the property for R750 000, you register the bond for R900 000 (the market value).” What we do not think about is what the outcome is for that real estate owner that has to sell the property at R750,000 pay commissions and eventually after all cost walks away with very little or most of the time nothing to start afresh. Real estate owners lose large sums of proceeds due to their current distressing situation through these transactions whilst you can achieve the same as below with a slight change in profit and substantially less risk.

RATHER IMAGINE THIS: Buying an R 1,000,000 property at R750,000 or lower (all transfer cost, maintenance etc. included), making predetermined returns (not hopeful returns) of 17% p.a. plus (R 127,000) whilst making a social and financial impact by buying time for the homeowner and unlocking cash to address the divorce, consolidation of debt and more, selling the property for an improved market value due to maintenance improvements and providing peace of mind to the homeowner whilst selling. Or if the homeowner qualifies, repurchase the property at a predetermined return to the real estate investor. Positive cash flows on all recovery transactions during the term irrespective of increases in rates, taxes levies, and interest rates for more information see watch this video

Assist Group and its partners are aiming to bring more awareness about this second and best approach when it comes to real estate investing and the distressed real estate industry.

- We encourage real estate owners to contact us if they find themselves in this situation where they will not only lose their home but also the proceeds they should receive for selling their property for its market value.

- Real estate agencies can contact us if you are interested in assisting real estate owners with alternative solutions, if need to still sell after research, secure a sole mandate to sell the property whilst maximizing the proceeds of the sale and provide peace of mind.

- We encourage Financial Institutions and Creditors to contact us to assist all parties in the process with quick and unique solutions that will result in a win-win for all.

- Attorneys, Bond originators, auditors, debt consolidation, debt review organizations, and others who are willing and able to help and participate, should visit our website www.assistgroup.co.za or contact enquire@assistgroup.co.za to learn more about how they can get involved or just call us on +27 21 201 5344.

We invite you to explore the rest of our website www.realestateassist.co.za if you are a homeowner or visit www.wealthassist.co.za if you are or want to be an Impact Real Estate Investor.