Table of Contents

Property Investment Mistakes to Avoid in South Africa in 2023:

Real estate has always been an attractive investment option, especially in South Africa where the property market has seen a lot of growth in recent years. However, investing in property can be quite tricky, and making mistakes can cost you dearly. In this blog post, we will look at some of the common property investment mistakes to avoid in South Africa in 2023, and how a real estate investment advisory like Wealth Assist can help you make better investment decisions.

Property Investment Research

- Not Doing Enough Research

One of the biggest mistakes that people make when investing in property is not doing enough research. Investing in property requires a lot of knowledge and understanding of the market, as well as the various regulations and laws that govern the industry. You need to be aware of the current market trends, property prices, and demand in the area where you want to invest. Failure to do your research could lead to you overpaying for a property, investing in an area that is in decline, or investing in a property that is not a good fit for your investment goals.

Property Investment strategy

- Not Having a Clear Investment Strategy

Another common mistake that people make when investing in property is not having a clear investment strategy. You need to have a plan for how you are going to invest in property, what kind of properties you are interested in, and what your investment goals are. Without a clear investment strategy, you may end up making impulsive investment decisions that are not in line with your long-term goals.

Property Rental Income

- Overestimating Rental Income

When investing in property, it is important to have a clear understanding of the rental income that you can expect to receive. Many people make the mistake of overestimating the rental income that they will receive, which can lead to financial difficulties down the line. Before investing in a property, it is important to do your research and get a realistic idea of the rental income that you can expect to receive.

Property Maintenance Costs

- Not Factoring in Maintenance Costs

Property investment is not just about buying a property and renting it out. You also need to factor in the costs of maintaining the property. Failure to do so can lead to unexpected costs down the line, which can eat into your profits. When investing in property, it is important to factor in the costs of repairs, maintenance, and upgrades, so that you can accurately assess the potential profitability of the investment.

Diversify, Diversify Diversify

“If you are not a professional investor, if your goal is not to manage money in such a way so you get a significantly better return than the world, then I believe in extreme diversification.”

- Not Diversifying Your Portfolio

Another mistake that many property investors make is not diversifying their portfolio. Investing all your money in one property or one area can be risky, as you are heavily exposed to any changes in that market. Diversifying your portfolio by investing in different types of properties or different areas can help to mitigate risk and improve your chances of success.

Property Investment Advisory in South Africa

- Not Seeking Professional Advice

Property investment can be complex, and it is important to seek professional advice before making any investment decisions. This is especially true for new investors who may not have the necessary knowledge and experience to make informed investment decisions. Seeking advice from a real estate investment advisory like Wealth Assist can help you to make better investment decisions and avoid costly mistakes.

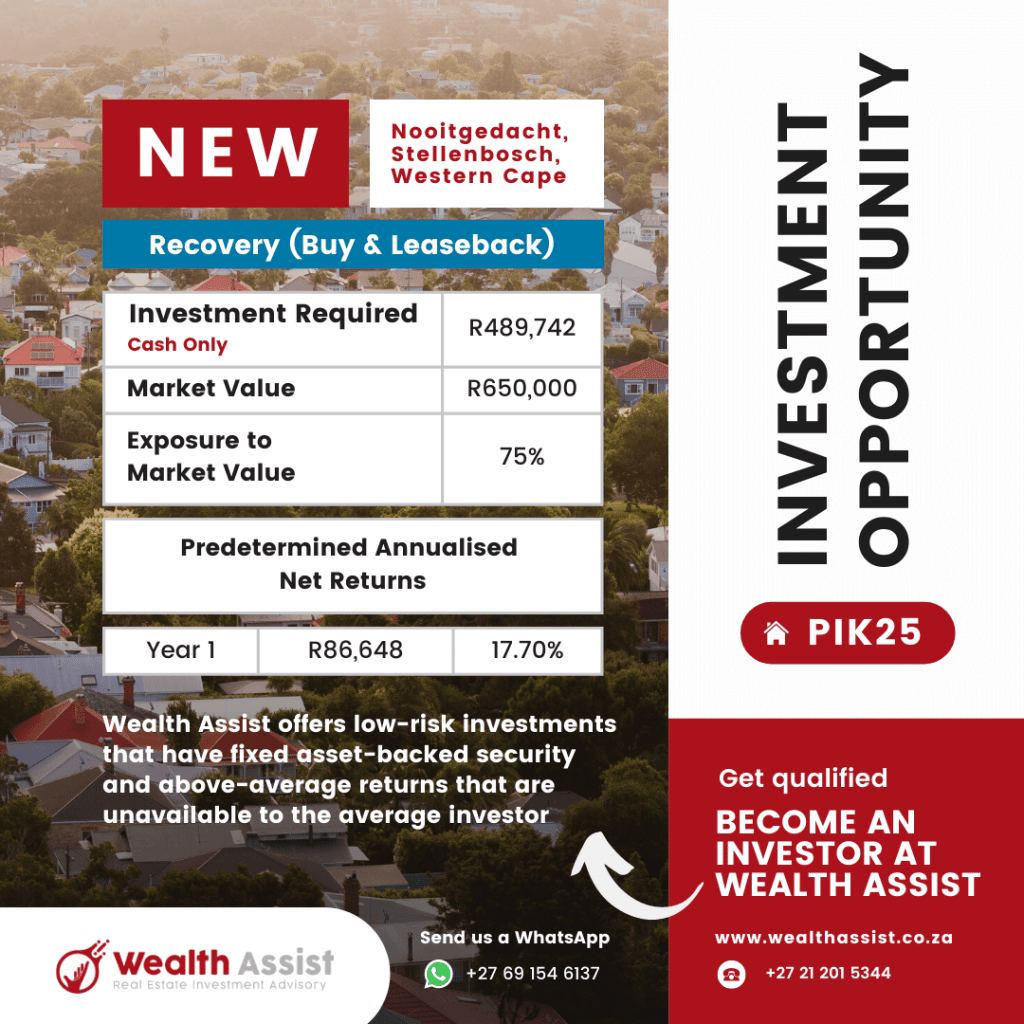

How Wealth Assist Can Help your property investment journey in South Africa

Wealth Assist is a real estate investment advisory that specializes in providing expert advice to property investors. With a team of experienced professionals, Wealth Assist can help you to make informed investment decisions that are in line with your investment goals. Here are some of the ways that Wealth Assist can help you to invest in property in South Africa in 2023:

Property Investment Analysis

- Investment Analysis

Wealth Assist can provide you with an in-depth analysis of the South African property market, helping you to identify the best areas to invest in and the types of properties that are likely to offer the best returns. This analysis is based on extensive research and market data, ensuring that you have a clear understanding of the market before making any investment

Property Investment Strategy in South Africa

- Investment Strategy

Wealth Assist can help you to develop a clear investment strategy that is in line with your investment goals. This includes identifying the types of properties that you should be investing in, the areas where you should be investing, and the risks and opportunities associated with each investment.

Property Portfolio management in South Africa

- Portfolio Management

Wealth Assist can also help you to manage your property investment portfolio. This includes analyzing your portfolio to identify areas for improvement, and making recommendations for how you can diversify your portfolio to reduce risk and improve your returns.

Property Investment Risk management

- Risk Management

Property investment can be risky, and Wealth Assist can help you to manage those risks. This includes conducting a thorough risk analysis of each investment opportunity, identifying potential risks, and developing strategies to mitigate those risks.

Property investment Transaction Support and Advice

- Transaction Support

Wealth Assist can also provide support throughout the entire investment process, from finding the right investment opportunities to negotiating the best deals and closing the transactions.

Why it is important to use a Real Estate Investment advisory like Wealth Assist

Investing in property is a major financial decision, and it is important to have all the necessary information and support to make informed investment decisions. A real estate investment advisory like Wealth Assist can provide you with the knowledge, expertise, and support that you need to make successful property investments. Here are some of the reasons why it is important to use a real estate investment advisory like Wealth Assist:

Property Investment Expertise

- Expertise

Wealth Assist has a team of experienced professionals who are experts in the South African property market. They have a deep understanding of the market, the risks and opportunities associated with property investment, and the best investment strategies for achieving your investment goals.

Latest Property Investment Data and Analysis

- Access to Information

Wealth Assist has access to a wealth of market data and information that can help you to make informed investment decisions. This includes information on property prices, market trends, and demand in different areas, as well as information on potential investment opportunities.

Property Investment Risk Mitigation and Security

- Risk Management

Property investment is inherently risky, and it is important to have a solid risk management strategy in place. Wealth Assist can help you to identify potential risks associated with your investments and develop strategies to mitigate those risks.

Successful Property Investment goals

- Portfolio Diversification

Diversification is key to successful property investment, and Wealth Assist can help you to diversify your portfolio to reduce risk and improve your returns. This includes identifying the types of properties that you should be investing in, the areas where you should be investing, and the risks and opportunities associated with each investment.

Property Investment Process made Easy

- Support throughout the Investment Process

Wealth Assist provides support throughout the entire investment process, from identifying investment opportunities to negotiating the best deals and closing the transactions. This can help to ensure that your investment is successful and that you achieve your investment goals.

Conclusion

Investing in property can be a lucrative investment option, but it is important to avoid the common mistakes that many property investors make. Not doing enough research, not having a clear investment strategy, overestimating rental income, not factoring in maintenance costs, not diversifying your portfolio, and not seeking professional advice are some of the common mistakes that property investors make.

A real estate investment advisory like Wealth Assist can help you to make informed investment decisions that are in line with your investment goals. Wealth Assist provides expertise, access to information, risk management, portfolio diversification, and support throughout the investment process. By working with Wealth Assist, you can make successful property investments in South Africa in 2023 and beyond.