The Foundation for Generational Wealth Building in South Africa: Property Investing

Generational Wealth Building in South Africa: South Africa’s property market is one of the most vibrant and lucrative in the world. Property investing can be a great way to build wealth and create generational wealth, allowing you to pass down assets to your children and grandchildren. Here we will discuss why property investing is essential for wealth creation in South Africa and how to maximize your potential returns.

Property investment is a form of wealth creation that has been used by many South African families to build generational wealth. It is an approach to building your financial future that provides stability, security and the potential for high returns. In this blog post, we’ll explore why property investing is such a powerful tool for creating generational wealth in South Africa and how it can be used to ensure lasting financial success.

The Benefits of Investing in Property:

There are many reasons why investing in property is beneficial. For starters, property investments tend to appreciate over time, meaning that you make money on your initial investment simply by holding onto it long enough. Furthermore, rental income from tenants can provide a steady stream of passive income that can help you pay off any debt associated with your purchase. Finally, unlike other forms of investing (like stocks or bonds), property investments are more stable and reliable as they tend not to suffer from dramatic market fluctuations like other asset classes do.

Property Tax Benefits:

Another reason why so many South Africans choose to invest in property is due to the tax benefits associated with it. In South Africa, any money you make from rental income or capital gains on your property investments is subject to Capital Gains Tax (CGT), which means that if you hold onto the property long enough, you could be eligible for CGT relief when selling it down the line. Additionally, certain expenses associated with owning a rental property are tax-deductible, meaning that you could end up paying less overall due to deductions on things like insurance premiums or repairs.

Investment Strategies for Generational Wealth Building:

When it comes to generating generational wealth through property investing, there are several strategies investors use in order to maximize their returns while minimizing risk. One popular strategy is known as “flipping,” which involves buying properties at a low price and then quickly selling them at a higher price once some minor renovations have been completed. Another popular strategy involves buying multiple properties over time and then renting them out for passive income streams over the long term; this method takes longer but can be very rewarding if done correctly as incomes increase each year while costs remain relatively fixed (i.e., mortgage payments).

Property investing offers many opportunities for those looking to build generational wealth in South Africa. With its potential for appreciation value combined with steady rental incomes and possible tax deductions and reliefs along the way, it’s an attractive option for those looking to secure their financial future and create lasting wealth across generations. With careful planning and research into the right markets and strategies, investors can maximize their returns while minimizing their risks—allowing them to set themselves up for financial success now and well into the future!

The Foundational Piece of Wealth Creation in South Africa

Why Invest In Property?

Property investments are generally considered one of the safest and most reliable investments available. It’s also an asset class that has shown consistent growth over time, with certain areas appreciating faster than others. Although it may not have the same level of liquidity as stocks or other financial instruments, property investments are relatively low risk compared to other investment classes. As an added bonus, when done right, you can derive additional income from rental payments if you decide to rent out your property.

The Benefits Of Investing In Property

Investing in property allows investors the opportunity to diversify their portfolio, reduce their overall risk exposure, and potentially increase their returns over time. The advantages of investing in property include:

• Tax benefits - Certain tax deductions can be made on rental income from properties such as depreciation expenses, mortgage interest payments and repair expenses.

• Leverage – Borrowers can leverage their investment funds by taking out a loan against their existing portfolio or by using available equity from other properties they own. This allows them to increase their returns while reducing their overall risk exposure.

• Appreciation - As mentioned earlier, certain areas may appreciate faster than others due to factors such as location or demand for the area which could lead to higher capital gains when the time comes to sell your property.

• Income potential - When renting out a property you have immediate access to regular income streams that could help cover costs associated with maintaining the investment such as taxes, repairs or mortgages payments for example.

Property investing is a great way for investors in South Africa to create wealth and build generational wealth that can be passed down through family lines for generations to come. With its relatively low-risk profile and potential for high returns over time it is an ideal asset class for those looking for long-term stability with growth potential at the same time. With proper research into local markets and an understanding of how best to leverage funds wisely you can maximize your potential return on investment when building a successful portfolio of properties in South Africa!WEALTH INVESTMENTS with Wealth Assist

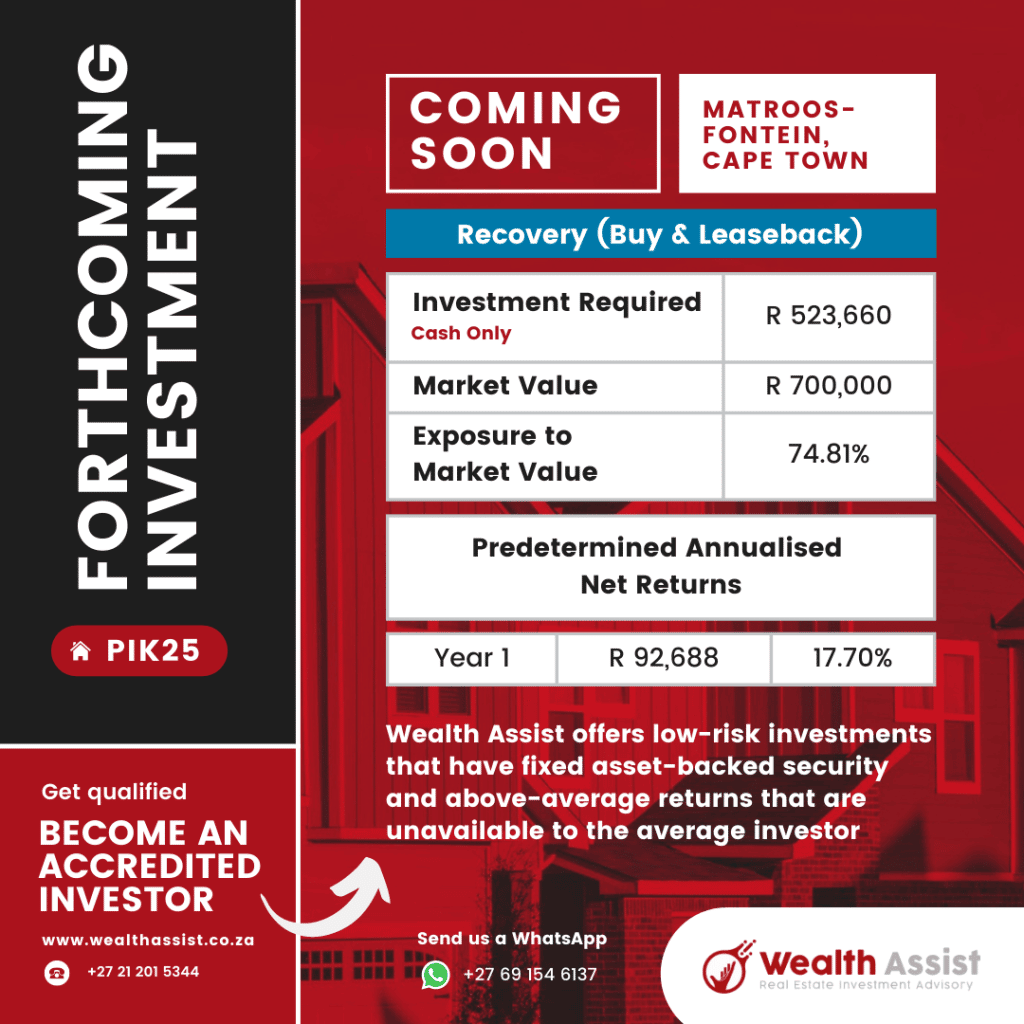

We are one of the few real estate investment firms in South Africa that provides a comprehensive, specialized, and professional service for wealth creation, protection, and investing by using low- to mid-level property as the underlying asset class.

When investors select to collaborate with Wealth Assist, they may rest confident in the knowledge that they are working with a qualified team of professionals who have created significant wealth for South Africans since 2010.